Should Real Estate Marketplaces Serve Traditional Players, or Compete with Them?

Five Lessons From the Evolution of Zillow and Redfin

Items This Article Will Cover

What is an Online Residential Real Estate Marketplace?

Analysis: Redfin Acquired by Rocket Mortgage

Relative stock performance since IPO

Key differences between both companies

Zillow’s business In detail

Redfin’s business in detail

Five reasons Zillow has achieved greater scale

Conclusion

Why You Should Read This Article

If you are a residential real estate agent, mortgage broker, real estate marketplace pro, you know that with Rocket’s acquisition of Redfin, Rocket becomes a major competitor to Zillow. If you are a commercial real estate marketplace watcher, the residential real estate market can provide clues about the future of other real estate markets, and marketplaces, namely that Zillow chose to serve the traditional real state market (similar to Costar), while Redfin chose to compete with the traditional market. This article provides a side by side look at these two companies and can help you look ahead for changes to come.

Summary

Zillow and Redfin represent two distinct residential real estate marketplace models. Zillow, focused on advertising revenue and agent partnerships, has grown significantly, with its stock rising 130% in the last five years. Redfin, a transaction-based brokerage employing its own agents, struggled with stock performance, and on March 10, 2025, Rocket Mortgage acquired Redfin, aiming to integrate search and financing processes. This ended Redfin’s journey as an independent company, and started a new one for the firm. Read on to find out why Zillow has scaled enough to remain the number one independent residential real estate marketplace.

What Is An Online Residential Real Estate Marketplace?

A residential real estate online marketplace is a digital platform that connects buyers, sellers, tenants, landlords, investors, and brokers to facilitate transactions involving residential properties, mortgages, and more.

Analysis: Redfin Acquired by Rocket Mortgage

On March 10, 2025, Rocket Mortgage announced that it was acquiring Redfin. "Rocket and Redfin have a unified vision of a better way to buy and sell homes," said Varun Krishna, CEO of Rocket Companies. "Together, we will improve the experience by connecting traditionally disparate steps of the search and financing process with leading technology that removes friction, reduces costs and increases value to American homebuyers."

Relative Stock Performance

Redfin Stock Performance

Prior to acquisition, Redfin’s stock had remained relatively flat since its IPO in 2017. And in the last five years, the stock has fallen by nearly 30%.

Zillow Stock Performance

Over the same five year period, Zillow’s stock has gained 130%. Overall, the stock has grown 160% since its IPO in 2011.

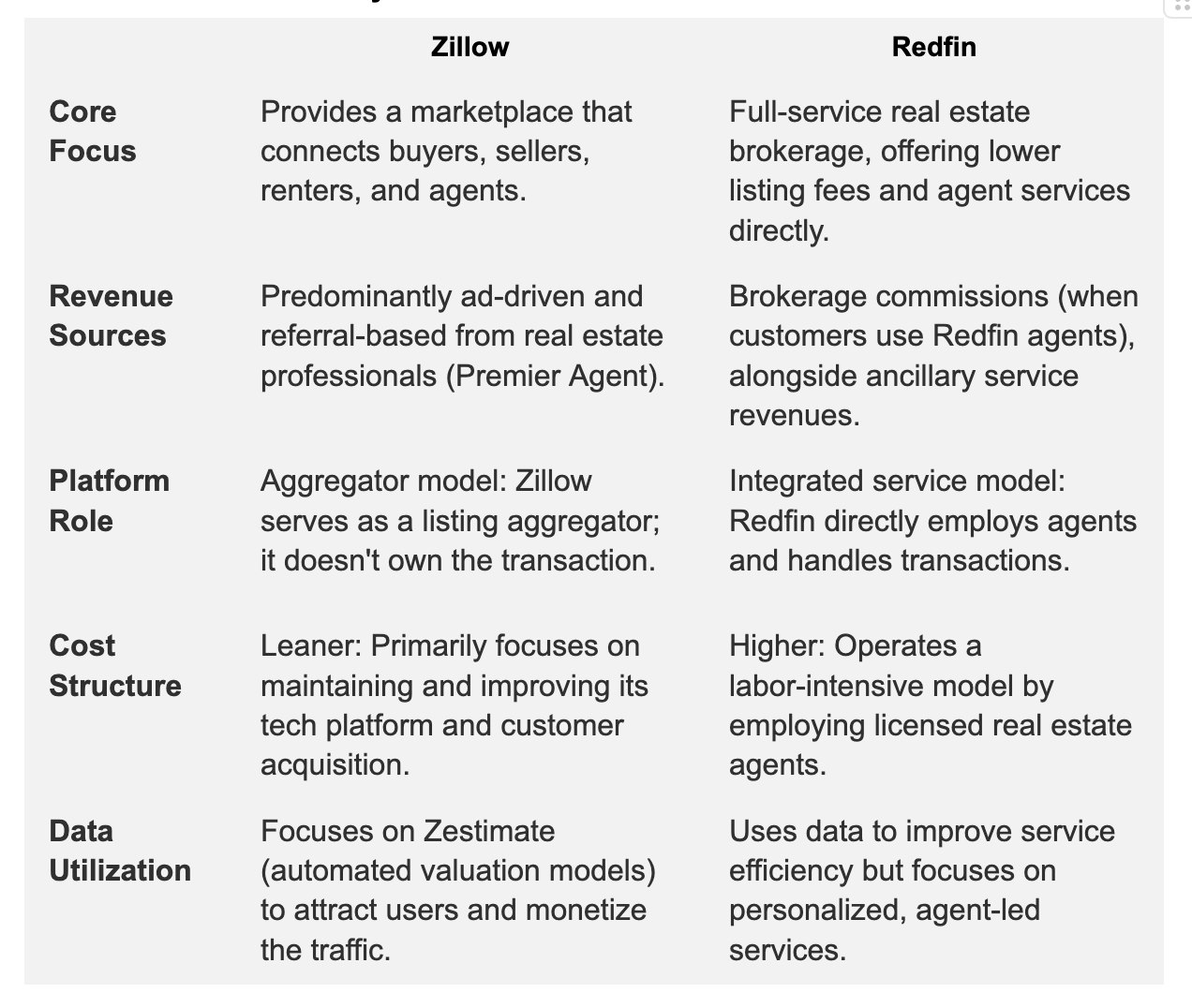

Key Differences Between Zillow and Redfin

If you’ve used both sites, you may think they are the same. After all, they both list tons of properties, have great, modern user experience, and provide excellent listing quality. But, what you may not know is that their customers are different, their business models are different, and more.

Zillow sells to agents; Redfin employs agents.

Zillow: Partners with existing agents (monetizes third-party agents)

Redfin: Employs salaried agents (vertically integrated)

Zillow makes money from advertising; Redfin makes money from commissions on successful home sales.

Zillow: Primarily advertising and lead-based

Redfin: Transaction-based commissions

Zillow generates revenue with less capital; Redfin is relatively capital (and labor) intensive.

Zillow: Lower capital needs (platform business) to enter markets

Redfin: Higher capital needs (employs agents, maintains offices) to enter markets

Zillow and Redfin Side by Side

Zillow’s Business Model

Zillow describes itself as “The most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated [but not employed - added by editor] partners and agents, and easier buying, selling, financing and renting experiences.”

Primary model: Zillow is a real estate website that generates revenue through advertising and lead generation services. From its 2024 10-K Filing, Zillow reported the following:

Revenue sources:

For Sale Residential Advertising and Lead Generation: 73% of Revenue

Advertising (Premier Agent, other):

Call Center Solutions

For Rent Residential Advertising and Lead Generation: 21% of Revenue

For Sale Mortgage Origination and Referrals: 6% of Revenue

Other:

Approach: Platform model connecting consumers with real estate professionals

Redfin’s Business Model

Redfin describes itself as a brokerage: “We help people buy and sell homes. Representing customers in approximately 100 markets in the United States and Canada, we are a residential real estate brokerage.”

Primary model: Redfin is a tech-enabled brokerage that employs its own agents, and makes money when it directly facilitates transactions. From its 2024 10-K Filing, Redfin reported the following:

Revenue sources:

Real Estate Services (From Purchases / Sale Transactions): 64% of Revenue

Brokerage Commissions (Representing Buyers and/or Sellers): 61% of Revenue

Partner Commissions (When Redfin refers a buyer to a Seller’s Agent and receives a portion of the commission): 3% of Revenue

Rentals: 20% of Revenue

Mortgage services: 14% of Revenue

Other: 4% of Revenue

Approach: Direct service provider disrupting traditional brokerage model

Five Reasons Zillow Has Achieved Greater Scale Than Redfin

Zillow aggregates listings and connects buyers/sellers with professionals, without being directly involved in the high-cost, labor-intensive work of hiring agents or conducting transactions. This allows Zillow to focus primarily on growing traffic and users, rather than managing region-specific operational complexities (e.g., hiring agents). Here is a bit more detail:

Agent Relationships that Support Current Norms:

Zillow's model works with the existing real estate industry rather than directly challenging it.

Redfin's discount model positions it as a disruptor, facing more industry resistance.

Advertising Revenue Model Instead of Transactions:

Zillow’s Premier Agent Program enables vast scaling opportunities, as it can monetize on a per-lead basis without needing to directly manage real estate transactions. This model requires less operational overhead than Redfin’s reliance on capturing commissions from completed sales.

Lower Cost Geographic Expansion:

Zillow's platform model allows it to expand rapidly across regions with minimal incremental costs. For instance, Zillow can focus investments on marketing and technological innovation rather than on staffing and agent training. Redfin’s model, requiring localized agents for each market, significantly slows down expansion due to operational and regulatory challenges.

Smart Marketing & Brand Strategies such as the “Zestimate”:

Zillow invested heavily in consumer-focused marketing to become synonymous with online real estate.

Their "Zestimate" feature became culturally significant, driving organic traffic.

Focus on consumer tools first, monetization second.

Network Effects that Don’t Require the Transaction Directly:

Zillow benefits from powerful network effects: as more buyers and renters visit Zillow, more agents advertise on the platform. In turn, this increases the supply of listings, drawing even more traffic. Redfin lacks the same "winner-takes-most" dynamics because its agent-based model doesn’t experience exponential growth in the same way.

Conclusion

Zillow has achieved greater scale primarily because its advertising driven platform business model enabled faster geographic expansion, stronger network effects, and broader consumer reach with lower capital requirements. While Redfin's model offers value through commission savings and employing its own agents, these very attributes limited its ability to scale as rapidly as Zillow's marketplace approach.

Zillow's focus on being a media and technology company first—rather than a brokerage—allowed it to build national scale and brand recognition before selectively adding transaction-based services, giving it a significant advantage in market penetration and overall business scale.

Lastly, Zillow focused on serving the traditional real estate brokerage industry while Redfin became a competitor to the existing brokerage industry. This strategy may play out in its favor (and in the favor of Rocket Mortgage), but it has not played out as well up until now.