LoopNet's Dominant Position in Commercial Real Estate: Will It Last Forever?

If you are a broker, tenant, or investor, you know that LoopNet is the dominant online Commercial Real Estate marketplace. Just how dominant? And where will LoopNet go next?

Items This Article Will Cover:

What is an Online Commercial Real Estate Marketplace?

LoopNet Overview and Market Position

Detailed Metrics about LoopNet’s Scale

LoopNet's Brand Recognition Among Different User Segments

LoopNet’s Digital Strategy and Evolution

LoopNet’s Brand Perception Challenges & Strengths

Future Positioning & Trends

Why You Should Read This Article:

If you are a broker, tenant, or investor, you know that LoopNet is the dominant Online Commercial Real Estate Marketplace. But how dominant? And where will LoopNet go next, as its parent company invests heavily in new sectors, such as residential real estate? If these answers are important to you, read on.

Summary:

LoopNet, owned by CoStar Group, is the largest commercial real estate online marketplace connecting buyers, sellers, tenants, landlords, investors, and brokers. With over 800,000 listings, 5-7 million monthly visitors, and 10+ million registered users, LoopNet commands 60-70% of US online CRE listing traffic.

The platform enjoys near-universal brand recognition among brokers (95%+) and high awareness among office tenants (85%+), retail tenants (75-80%), and investors (85-90%). Despite challenges with premium pricing and data quality, LoopNet maintains its dominance through continuous platform development, CoStar ecosystem integration, and its unique position as a marketplace rather than a service provider.

Unlike traditional firms like CBRE or JLL, LoopNet's value comes from marketplace liquidity and information access rather than advisory services.

What Is An Online Commercial Real Estate Marketplace?

In our recent post Evolution of Online Marketplaces in Commercial Real Estate (2025), we cover this topic in detail. A commercial real estate online marketplace is a digital platform that connects buyers, sellers, tenants, landlords, investors, and brokers to facilitate transactions involving commercial properties.

LoopNet Overview & Market Position

LoopNet (a CoStar Group’s subsidiary) is far and away the largest Online Commercial Real Estate Marketplace, with millions of views, hundreds of thousands of listings, and more. Just how dominant, relative to other players CREXI, VTS, and others?

LoopNet stands in a unique position within the commercial real estate ecosystem, functioning as the largest online marketplace for commercial property listings rather than as a traditional brokerage or property management firm.

Parent Company: CoStar Group (acquired LoopNet in 2012 for $860 million)

Platform Type: Commercial real estate listing marketplace and information service

Primary Users: Brokers, property owners, tenants, and investors

Listing Volume: Over 800,000 commercial property listings (largest CRE marketplace)

Geographic Coverage: Primarily United States with some Canadian and international listings

Revenue Model: Subscription-based (premium listings) and advertising-based

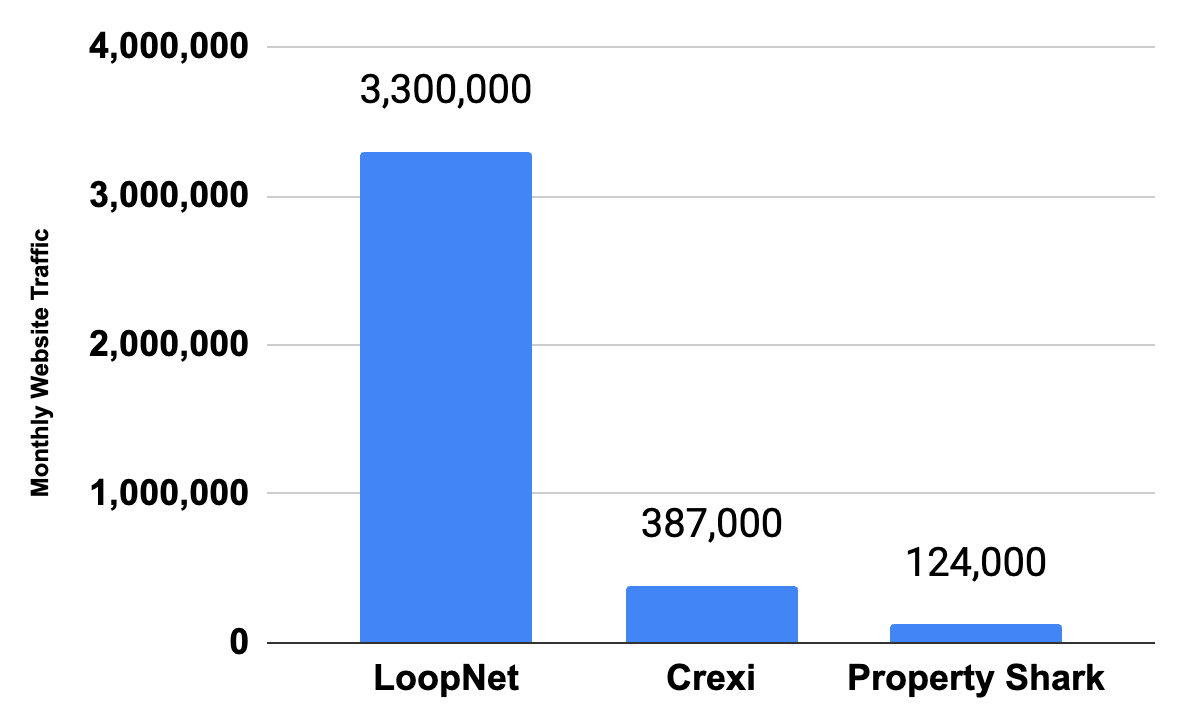

LoopNet Website Traffic Compared to Other Large CRE Marketplaces

Metrics About LoopNet’s Scale

How does LoopNet maintain its dominance in the Commercial Real Estate industry? By having the most traffic, though paid and organic channels, by having some of the highest user engagement in the industry, and the largest subscriber base in the industry.

1. Search Volume & Web Traffic

Monthly Search Volume: 3.1 million organic searches (SEMRush)

Total Website Traffic: 3.3 million traffic (SEMRush)

Organic Search Position: Dominates commercial real estate search terms, ranking for approximately 3 million keywords, including 163,000 in the top 3 positions (SEMRush)

Domain Authority: 71 (exceptionally strong in the CRE sector)

Referral Traffic: Primary source of digital leads for many commercial brokerages

Branded Traffic (on Loopnet brand): Represents 22% of all traffic (SEMRush)

2. Social Media & Content Engagement

LinkedIn Followers: 55,000 followers

YouTube Presence: 1,370 subscribers for training videos and market updates with moderate engagement

Content Marketing: Regular market reports and commercial real estate insights

3. Comparative Market Position

Market Share: Estimated 60-70% of online commercial real estate listing traffic in the US

Competitive Position: Primary competition comes from Property Shark, CREXi, VTS, and local MLS systems

Brand Recognition: Near-universal recognition among commercial real estate professionals

LoopNet's Recognition Among Different Asset Classes and User Segments

As a result of its high traffic and engagement numbers, LoopNet maintains strong brand awareness among users across various asset classes, including Office, Retail, Industrial, and investment. Further, LoopNet maintains high brand awareness among brokers, and, along with data and analytics packages from CoStar, occupies the position of being “necessary but expensive.”

1. Office Tenants

User Journey Position: Often the first or second online destination for office space search

User Sentiment: Viewed as comprehensive but sometimes overwhelming for small business tenants

Primary Use Case: Initial market research and option discovery

Engagement Pattern: Typically earlier in the tenant journey, often leading to broker engagement

2. Retail Tenants

User Journey Position: Often the starting point for space discovery

User Sentiment: Valued for location analytics and demographic tools

Primary Use Case: Site selection research and comparative market analysis

Engagement Pattern: Heavy use of mapping features and demographic overlays

3. Industrial Tenants

User Journey Position: One of several research channels, alongside broker relationships

User Sentiment: Appreciated for specification filtering but often lacks detailed industrial features

Primary Use Case: Initial market scanning and price discovery

Engagement Pattern: Often focused on logistics corridors and transportation access

4. Brokers & CRE Professionals

User Journey Position: Essential daily tool (Costar) for listing management and market research

User Sentiment: Viewed as necessary but expensive; some frustration with premium model

Primary Use Case: Listing marketing, competitive research, client presentations

Platform Dependence: High, with many brokers relying on LoopNet for significant lead generation

Premium Adoption: Approximately 40-50% of active brokers maintain premium accounts

LoopNet's Digital Strategy & Evolution

To maintain its dominance, LoopNet continues to invest, in its platform, and in its integration with the broader Costar Group ecosystem.

Recent Platform Developments

Search Enhancement: Implementation of AI-powered search to better match tenant requirements with available spaces

Visual Content Expansion: Increased emphasis on virtual tours, 3D walkthroughs, and professional photography

Mobile Optimization: Significant investment in mobile experience

Market Analytics Integration: Deeper integration with CoStar analytics to provide market context around listings

User Experience Redesign: Simplified interface launched in 2022 to improve navigation and reduce search friction

Integration with CoStar Ecosystem

Data Synchronization: Listings benefit from CoStar's extensive property database

Analytics Enhancement: CoStar's market analytics enrich listing information

Cross-Platform Strategy: Strategic positioning between CoStar (professional) and LoopNet (broader market)

Commercial Observer Integration: Content marketing synergies with CoStar's media properties

Ten-X Connection: Growing integration with CoStar's online transaction platform

LoopNet’s Brand Perception Challenges & Strengths

With its universal awareness and market position dominance, LoopNet’s brand enjoys many strengths, most notably being “the industry standard.” However, it also endures some challenges, namely around data quality, pricing/ROI/value proposition, and dependence on brokers as users, which mean the site may not be as user friendly for tenants. All in all, it occupies a unique brand position as the leading marketplace, complementing the largest CRE brands (CBRE, JLL), who are all service providers.

Strengths in Brand Positioning

Category Dominance: Near-monopoly status for online CRE listings

Brand Recognition: "LoopNet" often used generically for online CRE search (22% of traffic is branded)

Comprehensive Coverage: Unmatched depth and breadth of listings

Data Integration: CoStar data integration provides competitive advantage

Industry Standard: Default platform for most CRE professionals

Perception Challenges

Premium Model Friction: Frustration with tiered access and premium features

Data Quality Inconsistencies: Listing information sometimes outdated or incomplete

User Experience Complexity: Learning curve for new users, particularly small businesses

Broker Dependency: Perception as broker-centric rather than tenant-friendly

Value Proposition Questions: Some users question premium pricing structure

Comparative Position to Traditional CRE Brands

Unlike traditional CRE firms (CBRE, JLL, etc.) that provide services, LoopNet functions as a marketplace platform. This creates some important distinctions:

Engagement Type: Transactional rather than relationship-based

Brand Relationship: Utility-focused rather than service-oriented

User Loyalty: Based on marketplace liquidity rather than service quality

Trust Factors: Centered on information accuracy rather than advisor expertise

Value Proposition: Access to information vs. provision of expert services

Emerging Strategic Directions

As an aggressive market leader, LoopNet has multiple options for the future, these could include:

Transaction Enablement: Moving beyond listings toward facilitating transactions (integration with Ten-X)

AI-Driven Matching: Advanced algorithms to connect tenants with ideal spaces

Virtual Experience Expansion: Increased investment in virtual tours and digital space experiences

Data Service Expansion: Growing focus on providing additional market intelligence offerings

International Growth: Strategic expansion into stronger international presence

Direct-to-Tenant Tools: Development of more tenant-friendly self-service tools

Broker Enablement Evolution: Enhanced tools for brokers to leverage the platform more effectively

Conclusion: LoopNet is the Dominant CRE Marketplace and It Will Most Likely Stay that Way

LoopNet occupies a distinctive position in commercial real estate as the dominant digital marketplace rather than a service provider. While traditional CRE brands (CBRE, JLL, Cushman and Wakefield) focus on professional services and relationships, LoopNet's brand equity derives from its marketplace liquidity, comprehensive listings, and position as the default starting point for commercial property search.

Its near-monopoly position in online CRE listings gives it extraordinary brand recognition among both industry professionals and space users, though with different perception profiles. For professionals, it's an essential (if sometimes grudgingly used) tool; for tenants and investors, it's typically the first stop in the commercial real estate journey.

As the commercial real estate industry continues its digital transformation, LoopNet's position at the intersection of property data, market discovery, and transaction initiation gives it unique strategic importance in the evolving CRE technology stack.

And this dominance gives it a defensible “moat” against competitors, enjoyed only by a few select companies in industries around the world.