The Growth of Flexible Workspace (Coworking) Marketplaces (2025)

With online searches for coworking space growing at nearly 20% per year, these companies are poised to play a bigger role in the flexible workspace (coworking) ecosystem in the coming years.

Topics This Article Will Cover:

Is anyone looking for Flexible Workspace (Coworking) online?

What is Flexible Workspace (Coworking Space)?

What is an online Flexible Workspace Marketplace?

Key Characteristics of Flexible Workspace Marketplaces

What Advantages Do Flexible Workspace Marketplaces Have Over Going Direct to Operators (For Tenants)?

What Advantages Do Flexible Workspace Marketplaces Have For Space Operators?

What are the Largest Families of Flexible Workspaces in the World?

What Are the Largest Operator Flexible Workspace Marketplaces Partnerships in the World?

What are the Largest CRE Service Provider/Marketplace/Operator Partnerships in the World?

Why You Should Read This Article:

Flexible Workspace (Coworking) is the fastest growing sector of the office market, and has been for the past decade. Tenants looking for space in this sub sector typically start their search online. If you are a tenant, broker, or operator of a flexible workspace, you should read this article to learn how online marketplaces can help you or your business, or how they might change your business in the future.

Summary:

The article discusses the evolution of flexible workspace marketplaces, highlighting major partnerships like IWG/Instant, Yardi/WeWork and CBRE/Industrious. It defines these digital platforms as essential tools for discovering and booking flexible office solutions. Key characteristics include real-time availability, user reviews, and streamlined transactions, catering to both tenants and operators. Future trends involve AI integration, sustainability measures, and enhanced data intelligence, positioning these marketplaces as vital infrastructure in the hybrid work revolution.

What is Flexible Workspace (Coworking Space)?

Flexible workspace (coworking space) is a shared, fully-furnished office environment where individuals and organizations rent space on flexible terms. It offers turnkey amenities, community engagement, and scalable options—from hot desks to private offices—without long-term lease commitments, enabling businesses to adapt quickly to changing space needs.

Is Anyone Looking for Coworking Space Online?

Industry reports indicate that approximately 70-80% of people looking for flexible workspace or coworking space start their search online. This high percentage reflects the digital-first approach of the target demographic for flexible workspaces, which tends to be tech-savvy entrepreneurs, freelancers, professional services workers, remote workers, and modern businesses that naturally gravitate toward online research channels before making space decisions.

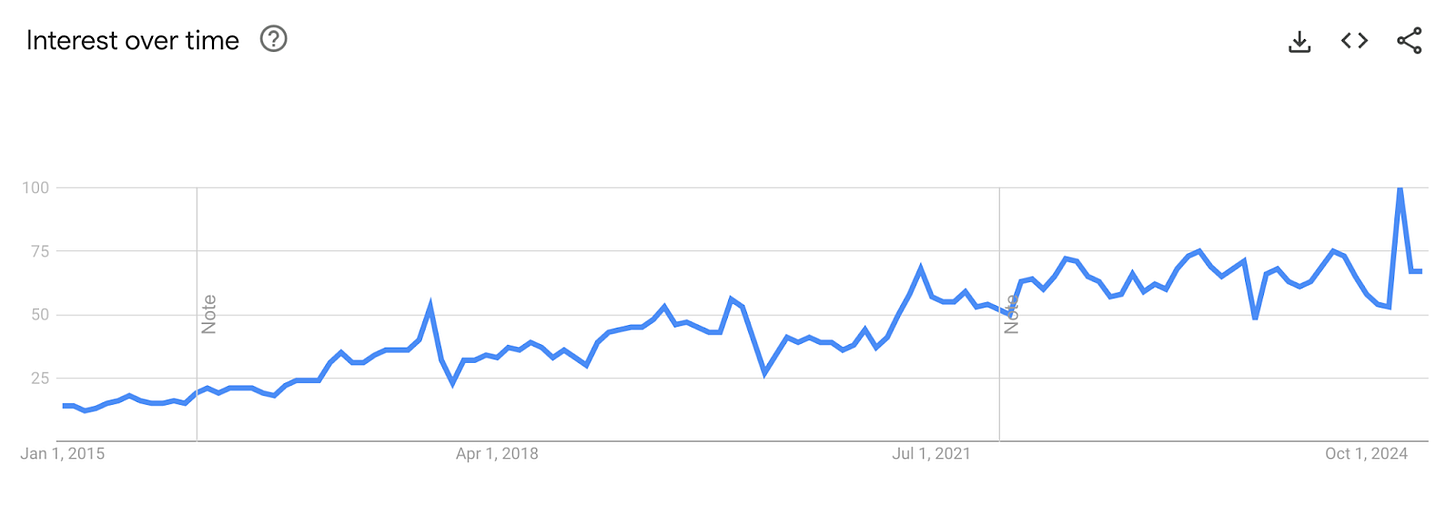

Online platforms and various aggregator sites have become the primary starting point for flexible workspace searches, with users typically comparing options, amenities, and pricing before contacting spaces directly or scheduling tours. The following chart reflects a 500% increase on the search term “coworking space” on Google from January 1, 2015 to March 2025 - a compound annual growth rate (CAGR) of 19.7%.

Searches for “coworking space” on Google 2015-2025

What is an Online Flexible Workspace Marketplace?

An online Flexible Workspace Marketplace is a digital platform that connects businesses seeking workspace (tenants) with providers offering flexible office solutions (landlords/operators), facilitating the discovery, comparison, and booking of coworking spaces, serviced offices, meeting rooms, and other short-term commercial real estate options. These platforms serve as centralized hubs where users can browse thousands of listings with transparent pricing, amenities, and availability information, often providing virtual tours, reviews, and streamlined booking processes that reduce the traditional friction of commercial leasing transactions.

Key Characteristics of Flexible Workspace Marketplaces:

Digital-First Platform: Web and mobile interfaces that allow users to search, compare, and transact workspace solutions online.

Aggregation of Supply: Consolidation of multiple workspace providers' inventory (coworking spaces, serviced offices, meeting rooms) in a single searchable database.

Real-Time Availability & Pricing: Up-to-date information on space availability, transparent pricing, and immediate booking capabilities.

Search & Filter Functionality: Advanced tools allowing users to filter by location, price, amenities, size, lease terms, and other specific requirements.

Highly Visual: High-quality photos, virtual tours, floor plans, and sometimes 3D walkthroughs of spaces.

Standardized Information: Consistent presentation of workspace details, amenities, and terms across different providers.

Review Systems: User-generated ratings and reviews of workspace experiences.

Streamlined Transaction Processing: Simplified booking, payment, and contract execution processes.

Reduced Intermediation: Direct connection between space seekers and providers, often reducing or eliminating traditional broker involvement.

Flexible Booking Terms: Options ranging from hourly to monthly or longer commitments with variable cancellation policies.

Value-Added Services: Additional offerings such as move-in coordination, IT setup, furniture rental, or other workspace-related services.

Data-Driven Insights: Analytics on space utilization, pricing trends, and marketplace activity.

Common Types of Flexible Workspace Marketplaces:

Pure Aggregator Platforms

Function primarily as listing directories

Display options from multiple providers without direct booking capabilities

Generate leads for workspace operators

Full-Service Marketplaces

End-to-end transaction capabilities

Allow search, booking, and payment processing

Handle the entire customer journey from discovery to occupancy

Broker-Supported Marketplaces

Combine technology with human brokerage services

Platform generates leads that are serviced by workspace consultants

Provide personalized guidance throughout the selection process

Operator-Owned Marketplaces

Created by workspace providers to showcase their own portfolio

May include limited inventory from partners or competitors

Primary focus on driving traffic to their own locations

Niche/Specialized Marketplaces

Focus on specific segments of flexible workspace

May target particular industries, workspace types

Subscription models providing access to networks of spaces

Users pay a recurring fee for workspace access across multiple locations

Enterprise-Focused Solutions

Designed specifically for large corporate clients

Offer centralized management of distributed workspace portfolios

Include advanced reporting, employee access management, and consolidated billing

Regional Specialists

Focus exclusively on specific geographic markets

Provide deep local expertise and inventory

What Advantages Do Flexible Workspace Marketplaces Have Over Going Direct to Operators (For Tenants)?

Comparison Shopping

Side-by-side evaluation of multiple options across different operators

Standardized presentation of amenities, pricing, and terms for easier comparison

Time savings from viewing multiple options in one platform versus visiting separate websites

Market Transparency

Access to broader market information on pricing, availability, and trends

Ability to benchmark offers against market standards

Reviews and ratings providing insights into actual user experiences

Negotiation Leverage

Awareness of competitive pricing across multiple providers

Ability to receive multiple quotes simultaneously

Some marketplaces offer negotiation support or pre-negotiated rates

Streamlined Search Process

Unified search parameters across multiple providers

Geographic filtering across all available inventory

Advanced filtering by amenities, size, price, and other requirements

Unbiased Recommendations

Independent view of the market not favoring a single operator

Recommendation algorithms based on user requirements rather than provider preferences

Access to broker expertise without operator-specific bias (in broker-supported models)

Administrative Efficiency

Single point of contact for multiple workspace needs

Consolidated billing options (on some platforms)

Standardized contracts and terms

Geographic Reach

Access to global inventory through a single platform

Easier expansion into new markets without establishing new operator relationships

Consistency in booking process across different locations

Special Deals & Incentives

Access to marketplace-specific promotions

Volume-based discounts unavailable to individual bookers

Last-minute deals on underutilized inventory

What Advantages Do Flexible Workspace Marketplaces Have For Space Operators?

Extended Marketing Reach

Access to broader audience beyond operator's direct marketing channels

Exposure to new customer segments

Reduced customer acquisition costs

Inventory Optimization

Opportunity to fill vacant spaces more quickly

Ability to monetize underutilized areas

Dynamic pricing capabilities based on market demand

Reduced Administrative Burden

Outsourcing of certain sales and customer acquisition functions

Standardized booking processes

Technology infrastructure provided by the marketplace

Market Intelligence

Insights into competitive pricing and offerings

Data on customer preferences and search patterns

Trends analysis across broader markets

What are the Largest Families of Flexible Workspace Marketplaces in the World?

One of the most interesting recent trends in Online Flexible Workspace Marketplaces is that many firms have been acquired by, or partnered with, large Flexible Workspace Operators, or service providers. These include the following types of Partnerships or acquisitions:

Operator/Marketplace Partnerships

IWG / Instant Group “Constellation” of Websites

Yardi / WeWork Collection of Websites

CRE Service Provider/Marketplace/Operator Partnerships

CBRE / Industrious

Savills / Workthere

Other Marketplaces

Liquidspace

Upflex

FlySpaces

OfficeFreedom.com

Office-Hub

Largest Operator/Marketplace Partnerships in the World

IWG/Instant Constellation of Flexible Workspace Marketplaces

IWG (Acquired the Instant Group in 2022)

IWG (International Workplace Group), is a global provider of flexible workspace solutions operating multiple brands including Regus, Spaces, HQ, and Signature, offering a range of options from coworking environments to fully-serviced offices across more than 4,000 locations in over 150 countries.

2024 Revenue: $3.8 billion

Number of Listings: 11,000+ locations across 120+ countries

Number of Sellers/Suppliers: IWG brands (Regus, Spaces, HQ, No18, Signature)

Launched consolidated marketplace integrating all sub-brands

Expanded franchise model adding 500+ new locations in 2023-2024

Launched "Regus Anywhere" hybrid work subscription in Q4 2023

Investing $250 million in digital platform enhancements through 2025

Coworker.com

Coworker.com is a global marketplace and review platform connecting businesses and professionals with over 19,000 flexible workspaces across 172 countries, offering detailed listings, verified reviews, and booking capabilities for coworking spaces, shared offices, and meeting rooms worldwide.

Acquired by IWG, then acquired by the Instant Group in a reverse acquisition in 2022

2024 Revenue: NA / Part of the Instant Group

Number of Listings: 19,000+ flexible workspaces

Number of Sellers/Suppliers: 15,000+ workspace operators across 172 countries

InstantOffices.com

InstantOffices.com is a well-established global workspace broker connecting businesses of all sizes to over 15,000 flexible workspace solutions across 3,000+ cities worldwide, offering a consultative approach to finding serviced offices, coworking spaces, and virtual office solutions with transparent pricing and personalized advisory services.

Part of the Instant Group, Acquired by IWG in 2022

2024 Revenue: N/A part of IWG

Number of Listings: 15,000+ locations worldwide

Number of Sellers/Suppliers: 8,500+ workspace providers across 3,000+ cities in 122 countries

Acquired by IWG in late 2022 in strategic consolidation move

Introduced sustainability and WELL rating system for workspace providers

Enhanced API capabilities for integration with corporate procurement systems

OfficeSpace.com

OfficeSpace.com is a listing platform acquired by the Instant Group/IWG.

2024 Revenue: N/A Part of the Instant Group

Number of Listings: 14,000+ US-focused listings

Number of Sellers/Suppliers: 6,500+ US landlords, brokers, and workspace providers

Enhanced search functionality with AI-powered matching technology

Introduced subscription model for broker partners - Lead Connect

Yardi / WeWork Collection of Marketplaces

Yardi

Yardi provides technology solutions for managing and marketing traditional and flexible office spaces, including coworking, private offices, and shared spaces, helping operators streamline bookings, billing, and space optimization.

2024 Revenue: Part of Yardi’s total estimated revenue of $1.6 billion, with its flexible office management platforms contributing a small portion.

Number of property listings: Supports thousands of flexible office spaces globally through its property management software.

Number of sellers/suppliers: Partners with coworking operators, landlords, and property managers worldwide to power their flexible workspace operations.

In 2024, Yardi launched new enhancements to its coworking management platform, including advanced analytics and integrations to support hybrid work trends.

WeWork.com (Acquired by Cupar Grimmond, affiliate of Yardi Systems)

WeWork.com is one of the largest coworking operators in the

2023 Revenue: $3.3 billion (2024 revenue not released)

Number of Listings: 450+ locations (down from 700+ pre-restructuring)

Number of Sellers/Suppliers: 1 primary (WeWork itself) plus 35+ enterprise partners

Reduced global footprint by 35% through lease terminations and renegotiations

Launched new enterprise-focused platform "WeWork for Business" in Q4 2023

Maintaining top position in search visibility despite reduced physical footprint

CommercialCafe

CommercialCafe is a comprehensive commercial real estate search platform that enables businesses, investors, and brokers to find, lease, or purchase office spaces, industrial properties, retail locations, and land across the United States through its extensive database featuring detailed property information, market analytics, and direct connections to listing agents.

2024 Revenue: N/A Part of Yardi

Number of Listings: 5,000+ flexible workspace listings (within broader CRE platform)

Number of Sellers/Suppliers: 3,000+ flexible workspace providers

Expanded data partnership with major brokerage firms

Introduced "CommercialCafe Pro" subscription tier for workspace operators

Hubble

HubbleHQ is a UK-based digital marketplace that helps businesses find and book flexible office space, including private offices, coworking spaces, and meeting rooms, through its tech-enabled platform that offers real-time availability, virtual tours, and personalized support throughout the search and transaction process.

Acquired by Yardi 2025

2024 Revenue: $8 to 10 million (estimated)

Number of Listings: 5,000+ primarily UK-focused

Number of Sellers/Suppliers: 2,800+ workspace providers

Launched in 5 new European markets including Germany and Spain

Introduced HQ-as-a-Service product for enterprise clients

Partnered with major UK corporations for hybrid work solutions

Deskpass

Deskpass.com is a flexible workspace membership platform that provides individuals and teams access to a network of coworking spaces, private offices, and meeting rooms across multiple cities.

Acquired by Yardi January 2025

2024 Revenue: Specific figures unavailable

Number of property listings: Over 1,000 flexible workspace locations worldwide.

Number of sellers/suppliers: Hundreds of workspace providers globally.

Recent news: In late 2023, Deskpass announced new features to support hybrid work models, including enhanced booking tools and expanded partnerships in Europe.

Largest CRE Service Provider/Marketplace/Operator Partnerships in the World

CBRE / Industrious

CBRE

CBRE, the largest real estate service provider in the world, offers a range of flexible office solutions, including coworking spaces, private offices, and hybrid workplace strategies, designed to support businesses needing adaptability in their real estate portfolios.

2024 Revenue: Part of CBRE’s total revenue, which exceeded $30 billion, with flexible office offerings contributing a growing segment.

Number of property listings: Thousands of flexible office spaces across global markets, integrated into CBRE’s extensive real estate platform.

Number of sellers/suppliers: Partners with numerous coworking operators, landlords, and flexible space providers worldwide.

In early 2024, CBRE expanded its agile workspace solutions by deepening partnerships with leading coworking brands and launching innovative tools to optimize workspace utilization.

Industrious Office (Acquired by CBRE in 2025)

Industrious is a premium flexible workspace provider offering curated, design-driven office solutions for businesses of all sizes across 170+ locations, now fully integrated with CBRE's global real estate platform, providing enterprise-level workspace experiences with a focus on professional design, hospitality-inspired service, and flexible lease terms.

2024 Revenue: $320 million (estimated)

Number of Listings: 170+ locations across 65+ cities worldwide

Number of Sellers/Suppliers: Operates spaces under 80+ management agreements with landlord partners

Expanded international presence with new locations in London, Singapore, Europe, and Toronto

Shifted to management agreement model, now representing 75% of portfolio

Launched enhanced technology platform "Industrious OS" for seamless client experience

Savills / Workthere

Workthere is a global flexible workspace advisory service backed by real estate giant Savills, that helps businesses of all sizes find and secure coworking, serviced offices, and other flexible workspace solutions through its specialized broker network offering personalized, expert guidance and leveraging Savills' extensive property market expertise.

2024 Revenue: $3-5 million (estimated from marketplace operations), part of Savills

Number of Listings: 7,000+ flexible workspaces globally

Number of Sellers/Suppliers: 4,000+ workspace providers

Expanded into 10 new countries in 2023-2024, now operating in 40 markets

Launched "Workthere Analytics" platform providing market intelligence

Enhanced enterprise client services division with dedicated team

Introduced sustainability ratings for all listed properties

Other Marketplaces

Upflex

Upflex is a B2B marketplace and SaaS platform that provides enterprises with a global network of flexible workspace solutions across 6,000+ locations in 80+ countries, enabling companies to manage hybrid work policies through a centralized booking system with detailed analytics and custom reporting capabilities.

2024 Revenue: $5 million (estimated)

Number of Listings: 6,000+ spaces in 1,600+ cities

Number of Sellers/Suppliers: 3,500+ workspace providers

Raised $30 million Series B funding in 2022 led by WeWork, Newmark, and Cushman Wakefield

Launched carbon impact tracking for workspace usage

Established strategic partnership with SAP for corporate integration

Acquired European competitor FlexiPass to strengthen EMEA presence

FlySpaces (Southeast Asia)

FlySpaces is a Southeast Asian digital marketplace platform that connects businesses to flexible workspace solutions, including coworking spaces, serviced offices, meeting rooms, and event venues across major cities in the region, functioning as an "Airbnb for office spaces" with a focus on short-term and flexible commercial real estate solutions.

2024 Revenue: $1 million estimated

Number of Listings: 3,000+ spaces across Southeast Asia

Number of Sellers/Suppliers: 1,800+ workspace providers

Secured $10 million Series B funding from Ant Financial in December 2023

Expanded operations into Vietnam and Thailand markets

Launched enterprise platform targeting multinational corporations in ASEAN

Introduced "FlySpaces Pass" for multi-location access

Partnered with regional banks for SME workspace support programs

OfficeFredom.com

Office Freedom is a global workspace brokerage firm that helps businesses find and secure flexible office space solutions, including coworking spaces, serviced offices, and managed offices, by offering a free, personalized search service with access to thousands of workspace options across more than 1,000 cities worldwide.

2024 Revenue: $5 million

Number of Listings: 5,000+ European-focused spaces

Number of Sellers/Suppliers: 3,200+ workspace providers

Rebranded from Search Office Space to Office Freedom

Launched enhanced client advisory services division

Expanded operations into North American market

Introduced sustainability certification for listed properties

Office-Hub.com

Office Hub is Australia and Asia Pacific's largest office space marketplace, connecting businesses with thousands of flexible workspace solutions including coworking spaces, serviced offices, and virtual offices through its innovative Abacus technology platform that features real-time availability, transparent pricing, and a personalized matchmaking service.

2024 Revenue: $7 million (estimated)

Number of Listings: 6,000+ with focus on Australia, NZ and Asia

Number of Sellers/Suppliers: 3,000+ workspace provider

Expanded into Japanese market with localized platform

Launched data analytics platform for workspace providers

Enhanced enterprise service division with dedicated team

Conclusion

As we enter 2025, the flexible workspace marketplace ecosystem has matured into a sophisticated network dominated by strategic consolidations and technological innovation. What began as fragmented digital listing platforms has evolved into integrated ecosystems where the lines between operators, brokers, and technology providers have significantly blurred. The industry's consolidation into major "families" - led by IWG/Instant's constellation, Yardi's expanding portfolio following the WeWork acquisition, and the deepening integration between traditional CRE firms and flex operators like CBRE/Industrious - signals a transformative phase where scale, data intelligence, and seamless user experience have become the defining competitive advantages. These marketplace platforms now serve not merely as transaction facilitators but as essential infrastructure for the hybrid work revolution, offering enterprises unprecedented visibility, flexibility, and intelligence in managing distributed workspace portfolios while providing operators with expanded distribution channels and operational efficiencies that were unimaginable just a few years ago.

Future Trends in Online Flexible Workspace Marketplaces

Artificial Intelligence Integration

AI-powered matching algorithms for workspace recommendations

Predictive analytics for workspace utilization

Personalized workspace suggestions based on company culture and work patterns

Automated space optimization recommendations

Sustainability-Driven Platforms

Carbon footprint tracking for workspace selections

Green certification scoring for workspace providers

Sustainability performance metrics in marketplace listings

Carbon offset options during booking process

Hybrid Work Ecosystem Solutions

Advanced analytics for distributed workforce management

Integration with HR and workplace management systems

Real-time occupancy and collaboration space tracking

Workforce distribution intelligence

Blockchain and Tokenization

Transparent, secure transaction processing

Fractional workspace ownership models

Smart contracts for flexible lease agreements

Decentralized marketplace protocols

Enhanced Data Intelligence

Predictive pricing models

Real-time market trend analysis

Comprehensive workspace performance benchmarking

Machine learning-driven market insights

Hyper-Personalization

AI-curated workspace recommendations

Customized workspace packages

Integrated workplace experience scoring

Personalized amenity and service matching

Augmented Reality (AR) Integration

Virtual and augmented reality workspace tours

Immersive space preview experiences

Digital twin technology for workspace visualization

Remote workspace collaboration environments

Enterprise-Grade Platforms

Consolidated global workspace management

Advanced compliance and security features

Integrated budgeting and procurement tools

Comprehensive workforce mobility solutions

Health and Well-being Metrics

WorkTech wellness scoring

Indoor environmental quality ratings

Mental health and productivity tracking

Ergonomic and design compatibility assessments

Geospatial Intelligence

Hyperlocal workspace discovery

Commute optimization algorithms

Neighborhood ecosystem analysis

Integrated transportation and accessibility scoring

Subscription and Membership Models

Flexible, tiered workspace access plans

Cross-platform workspace memberships

Modular workspace packaging

Enterprise-wide workspace subscriptions

Regulatory Technology (RegTech)

Automated compliance checking

Cross-border workspace regulations navigation

Real-time legal and tax optimization

International workspace governance tools